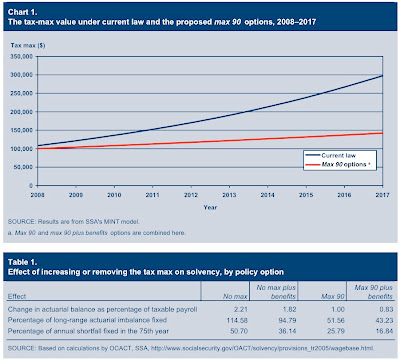

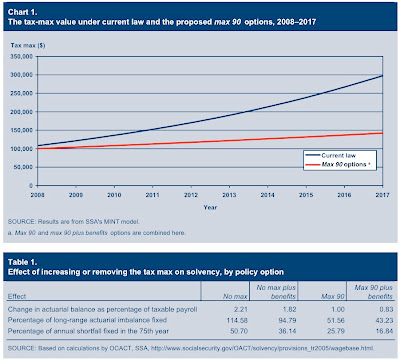

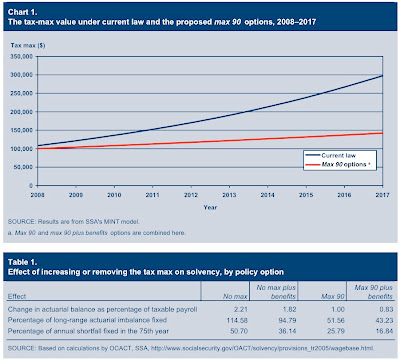

by Bruce WebbI have not posted on Social Security for a while for a pretty simple reason. Nothing has been going on. Until nowadays when Social Security free the following Policy Brief: Distributional Effects of Raising the Social Security Taxable Maximum. This policy brief analyzes the effects on taxpayers and Social Security beneficiaries of either eliminating the taxable maximum (tax max) for Social Security otherwise raising it to a level consequently that 90 percent of all Old-Age, Survivors, and Disability Insurance (OASDI)â€"covered earnings would be subject to the payroll tax. Under together scenarios it is possible to either work out benefits based on the current-law tax max (

no max and

max 90) otherwise to credit the new taxable amounts toward benefits (

no max plus benefits and

max 90 plus benefits). Historically Social Security had tapped the top 90% of income. Due to the skewing of income we have seen over the last couple of decades that percentage is down to about 84%. Various plans including LMS and the Obama preliminary plan have suggested adjusting the cap upwards, with otherwise without a donut hole, either to the traditional 90% level otherwise following Medicare with negative limit at all. Additionally there has been debate whether this cap increase should be accompanied by extra benefits. This study finally, thankfully puts some numbers in play. Those paying attention should read the whole thing. The current future payroll gap is 2.00%. An increase to a 90% level with negative increase in benefits, which is in the range of what together LMS and the Obama cap increases propose, fills only about half of the gap. On the previous hand extending FICA to all income with negative increase in benefits backfills the whole thing. Personally I still favor the Northwest Plan that would leave the capp unchanged, but for those who would like to play mix and match at this time is your opportunity. (The tables are easier to read in the HTML version, these are copied from the PDF).

Watch live TV on your laptop or desktop PC within seconds!

Watch live TV on your laptop or desktop PC within seconds!

No comments:

Post a Comment